Ever wondered why Nigeria operates multiple exchange rates, while most countries have a single one? The naira isn't just over rated—it's systematically managed through a complex web of policies that create artificial scarcity, maintain economic illusions, and shift real costs to ordinary Nigerians.

Understanding why this system exists helps you predict rate movements, navigate policy changes, and position yourself ahead of market shifts.

Key Points

- Historical roots: Foreign exchange controls from the military era (1980s-1990s)

- Policy goals: Manage import demand, protect foreign reserves, maintain the stability illusion

- Economic reality: Artificial scarcity creates premium markets and rent-seeking

- Your advantage: System knowledge helps predict policy impacts on rates

The Birth of Multiple Rates

Nigeria's multiple exchange rate system emerged during the 1980s economic crisis. Facing foreign exchange shortages and mounting import bills, military governments introduced exchange controls to ration scarce dollars.

What started as emergency measures became permanent features. Each administration added new windows, committees, and allocation mechanisms—creating today's maze of official rates, intervention rates, and parallel markets that most Nigerians navigate daily.

Evolution of Nigeria's multiple exchange rate system from crisis to permanence

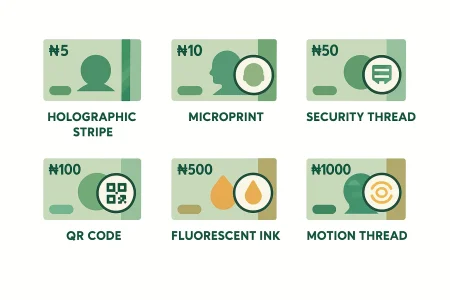

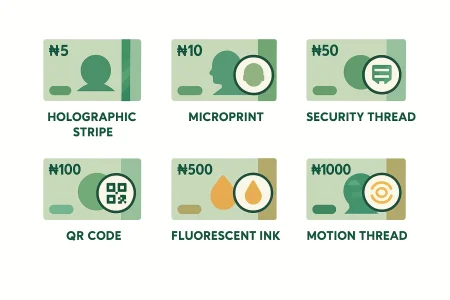

How Artificial Scarcity Works

The CBN doesn't just set rates—it controls supply. Through forex allocation windows, documentation requirements, and end-user certificates, the bank determines who gets dollars and at what price.

This creates intended consequences: reduced import pressure and preserved reserves. But it also creates unintended effects—parallel markets, rent-seeking, and the premium rates that importers eventually pass to consumers as higher prices.

The Political Economy of Exchange Rates

Multiple rates serve political functions beyond economics. Official rates maintain the illusion of naira stability for international credibility. Parallel rates reveal market reality but operate in legal grey areas.

This system enables policymakers to claim exchange rate stability while market participants bear the actual costs. Every Nigerian importing goods, sending remittances, or travelling abroad experiences this policy choice through higher prices.

How to anticipate naira rate movements using policy signal patterns

Policy Patterns You Can Predict

Understanding the system helps you anticipate changes:

- Election cycles often bring promises of rate convergence that rarely materialise.

- Oil price movements impact foreign exchange supply and prompt policy adjustments.

- IMF negotiations pressure rate unification but face domestic resistance.

Recent Reform Attempts

President Tinubu's administration promised rate unification, which led to a significant devaluation of the naira in 2023. However, spreads between official and parallel markets persist, showing how deeply embedded the multiple rate system remains.

Each reform attempt faces the same challenge: unifying rates requires either a massive foreign exchange injection or accepting significant naira depreciation. Political pressure typically favours maintaining the illusion over accepting the reality.

Understanding the system gives you a predictive advantage

Quick FAQ

- Why doesn't Nigeria use a single exchange rate? Political fear of devaluation and loss of forex allocation control. Multiple rates hide true costs while maintaining policy flexibility.

- When will rates unify? History suggests convergence during crises, followed by divergence during stability. Permanent unification requires a fundamental policy commitment that Nigeria hasn't sustained.

- How do I use this knowledge? Track oil prices, election cycles, and IMF pressure for rate movement signals. Position accordingly rather than react to policy announcements.

Naira Over Rated isn't just wordplay - it's a systematic reality. Smart Nigerians understand the forces behind the forex policy and position accordingly. Need current rate intelligence? Check Naira Over Rated I for today's official vs parallel quotes or track daily conversion updates to time your next move.

Internal Resource:

- Naira Over Rated I: Official Vs Black Market Naira Rates

- Daily Rate series

- Naira series hub

- CBN forex policies: Monetary Policy | Central Bank of Nigeria (Checked June 28, 2025)

- IMF Nigeria programs: Nigeria and the IMF (Checked June 28, 2025)