The House of Representatives Committee on Financial Crimes has called upon Richard Teng, the Chief Executive Officer of Binance Holding Limited, to address allegations of terrorism financing and money laundering. The summons, issued by Committee Chairman Ginger Onwusibe, sets a tight deadline, requiring Binance's top executive to appear before the committee on or before March 4, 2024.

Binance, a well-known online cryptocurrency exchange, has recently come under scrutiny from the Central Bank of Nigeria, which has raised concerns about potential involvement in money laundering activities.

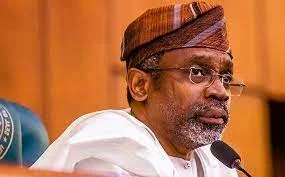

Expressing dissatisfaction with Binance's lack of cooperation, Onwusibe highlighted the company's refusal to attend hearings and address the committee's inquiries. He emphasized the committee's responsibility to protect Nigeria's financial integrity and shield citizens from the threats posed by financial crimes, especially amid the country's economic challenges.

The committee's commitment to holding Binance accountable is grounded in its constitutional duty to uphold the rule of law and safeguard Nigerian investors from exploitative practices. Onwusibe underscored the severity of the allegations against Binance, emphasizing the imperative to prevent the flow of illicit funds that could potentially support terrorism and exacerbate economic challenges.

The current impasse between Binance and the House committee reflects the broader complexities of regulating the cryptocurrency landscape in Nigeria. As the nation grapples with economic instability and heightened concerns over financial security, the resolution of this legal situation could shape the trajectory of cryptocurrency regulation within Nigeria and potentially influence global discussions on the matter.

As the deadline approaches, attention is focused on Binance and its CEO, Richard Teng, as they navigate the regulatory landscape in a country determined to protect its financial system and citizens from the risks associated with financial crime. The outcome of this inquiry may have lasting implications for the regulation of cryptocurrency not only in Nigeria but also in the wider international context.