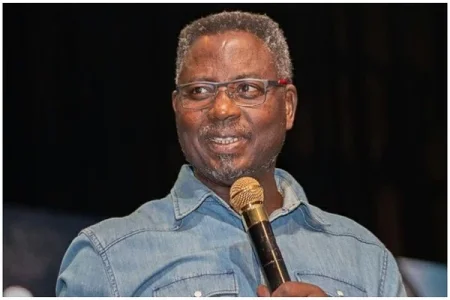

Matthew Ashimolowo revealed significant losses from investing in Nigerian bank stocks. He shared experiences of buying shares in First Bank, Skye Bank, and GTBank at high prices, only for their values to plummet. His story underscores the risks of investing in bank shares and the challenges with loan repayments.

In a recent statement, Matthew Ashimolowo detailed his significant losses in Nigerian bank stocks, revealing a history of poor investments. He recounted purchasing First Bank shares at 36 Naira each, which plummeted to 12 Naira, resulting in substantial losses. Ashimolowo also shared his experience with Sterling Bank, from which he borrowed 60 million Naira in the mid-2000s to invest in Skye Bank shares.

Unfortunately, these shares dropped from 14 Naira to just 2.50 Naira, forcing him to repay the loan under pressure from the bank. Additionally, he described another misstep with GTBank, where shares bought at 18 Naira fell to 3.60 Naira.

Ashimolowo's comments highlight the risks associated with investing in bank shares and the challenges faced by investors dealing with fluctuating stock values and aggressive debt collection practices by financial institutions.