tax reform

-

Nigeria Tax Reform Chief Oyedele Mandates All Individuals to File Annual Returns by March 31

The Digest: Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has directed that all individual taxpayers in Nigeria must file their annual tax returns by March 31. Speaking at a webinar for finance professionals, Oyedele emphasized that compliance is a...- Nigeria News

- Article

- 2 min read

- new tax law taiwo oyedele tax reform

- Category: Business

-

Nigeria Oyedele: Tax Reform Resistance Led by Those Who “Made Money for So Long Without Paying Taxes”

The Digest: Taiwo Oyedele, Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, has stated that opposition to Nigeria’s tax reforms is driven by individuals and entities who have long profited without paying their fair share. Speaking at a business event in Lagos, Oyedele...- Nigeria News

- Article

- 1 min read

- taiwo oyedele tax evasion tax reform

- Category: Business

-

Nigeria Tax Reforms Increase January Take-Home Pay, Says Taiwo Oyedele

The Digest: Taiwo Oyedele, Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, has announced that Nigerian workers are beginning to see higher take-home pay due to reduced Pay As You Earn (PAYE) deductions under the country's newly enacted tax laws. In a post on social media...- Nigeria News

- Article

- 1 min read

- new tax law paye taiwo oyedele tax reform

- Category: Business

-

Nigeria Minority Lawmakers Report Discrepancies Between Passed and Gazetted Tax Laws

The Digest: The House of Representatives minority caucus has alleged that illegal alterations were made to recently gazetted tax reform laws. According to a statement by the caucus committee chairman, Afam Ogene, a review revealed discrepancies between the laws passed by the National Assembly...- Nigeria News

- Article

- 1 min read

- house of representatives tax reform

- Category: Politics

-

Nigeria Nigeria’s Tax Chief Denies “Pause” on New Laws, Blames Gazette Verification Delay

The Digest: The chairman of Nigeria’s Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has dismissed reports of a paused rollout of new tax guidelines, calling the narrative “fake news” and attributing the delay to a procedural legislative check. Key Points: Tax...- Nigeria News

- Article

- 1 min read

- taiwo oyedele tax reform

- Category: Business

-

Nigeria Tax Reform Chief Downplays Controversial Changes to New Laws as Uncertainty Grows

The Digest: Presidential Tax Reform Chairman Taiwo Oyedele has insisted that “few changes” made to the newly enacted tax laws will not alter their core provisions, even as allegations of discrepancies between the gazetted versions and what was passed by the National Assembly deepen public...- Nigeria News

- Article

- 1 min read

- national assembly taiwo oyedele tax reform

- Category: Business

-

Nigeria Taiwo Oyedele Reveals Personal Threats Over Nigeria’s Tax Reform Push

The Digest: Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has disclosed that he faces personal threats for leading Nigeria’s contentious tax overhaul Key Points: Taiwo Oyedele states he receives threats for leading Nigeria’s tax reform efforts. He...- Nigeria News

- Article

- 1 min read

- taiwo oyedele tax reform

- Category: Business

-

Nigeria Peter Obi Compares Nigeria’s New Tax System to Extortion, Calls for Suspension

The Digest: Former presidential candidate Peter Obi has condemned Nigeria’s new tax laws, calling them a form of “extortion” that lacks clarity, public consultation, and a clear social contract, revealing a deepening disconnect between policy and public trust in a system already straining...- Nigeria News

- Article

- 1 min read

- kpmg nrs peter obi tax reform

- Category: Politics

-

Nigeria Oyedele Hits Back at KPMG Over Tax Act Critique, Cites "Misunderstanding"

The Digest: The Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, has issued a strong rebuttal to a recent analysis by KPMG Nigeria, stating the firm "does not understand" the policy intent behind the newly enacted Nigeria Tax Act (NTA). He challenged the...- Nigeria News

- Article

- 1 min read

- kpmg taiwo oyedele tax reform

- Category: Business

-

Nigeria NLC to FG: Suspend New Tax Laws Now or Face Workers’ Showdown

The Digest: The Nigeria Labour Congress has issued a stern demand for the immediate suspension of the newly enacted tax laws, warning the Federal Government of potential industrial unrest if implementation continues. NLC President Joe Ajaero criticized the laws as regressive, exclusionary, and...- Nigeria News

- Article

- 1 min read

- joe ajaero nlc tax reform

- Category: Metro

-

Nigeria Your Guide to Nigeria's New Tax System: Rates, Exemptions & Rules

The Digest: Nigeria's new tax laws that took effect on January 1, 2026, represent a major fiscal overhaul designed to simplify and broaden the revenue base, but their implementation has been clouded by significant misinformation and public panic that requires urgent clarification. Key Points...- Nigeria News

- Article

- 1 min read

- new tax law nigeria revenue service nrs tax reform

- Category: Business

-

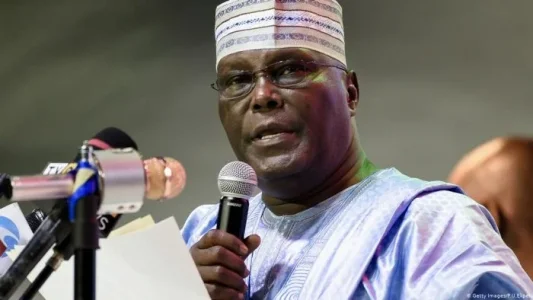

Nigeria Atiku Insists Tax Law Is Illegal, Warns Against Constitutional Breach

The Digest: Former Vice President Atiku Abubakar has called the newly gazetted tax reform law a “nullity” and accused the government of forging legislation, after the Senate confirmed that the published version does not match what was passed by the National Assembly. In a strongly worded...- Nigeria News

- Article

- 1 min read

- atiku abubakar national assembly tax reform

- Category: Politics

-

Nigeria Air Peace CEO Warns New Tax Law Could Push Airfares to ₦1 Million

The Digest: Air Peace Chairman Allen Onyema has warned that Nigeria’s new tax provisions could force domestic airfares beyond ₦1 million and risk collapsing local airlines within months. In an interview with ARISE NEWS, Onyema criticized what he called “multiple and overlapping” charges...- Nigeria News

- Article

- 1 min read

- air peace allen onyeama tax reform

- Category: Business

-

Nigeria FG Insists New Tax Laws Begin January 1 Despite Controversy

The Digest: The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has confirmed the Federal Government will proceed with implementing new tax legislation on January 1, 2026, despite recent controversies. Key Points: Oyedele stated the rollout is on...- Nigeria News

- Article

- 1 min read

- firs taiwo oyedele tax reform

- Category: Politics

-

Nigeria Taiwo Oyedele Exposes Nigeria's Tax Crisis: Fewer Than 10 Million Payers in a Nation of Millions

# The Digest: Tax reform chief Taiwo Oyedele has revealed that Nigeria has fewer than 10 million active individual taxpayers, a figure he argues should be the baseline for Lagos State alone. Speaking at the Tax Reform Summit 2026, Oyedele emphasized the critical need for improved data...- Nigeria News

- Article

- 1 min read

- taiwo oyedele tax reform

- Category: Business

-

Nigeria Nigerians Won't Lose Bank Access Over TIN in 2026, Tax Reform Chief Assures

The Digest: With 11 days until Nigeria's new tax regime takes effect, the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has moved to calm public anxiety, clarifying that bank accounts will not be blocked from January 1, 2026, solely due to the lack of...- Nigeria News

- Article

- 1 min read

- nigeria tax act 2025 taiwo oyedele tax reform tin

- Category: Business

-

Nigeria Tax ID Enforcement Begins January 2026: Key Facts Every Nigerian Should Know

The Digest: As the January 1, 2026, enforcement date for Tax Identification Number (Tax ID) compliance approaches, widespread confusion has prompted official clarifications to dispel myths and outline the new requirements. The policy, anchored in the Nigerian Tax Administration Act 2025, aims...- Nigeria News

- Article

- 1 min read

- firs nin tax id tax reform tin

- Category: Business

-

Nigeria One-Third of Nigeria’s Workforce to Be Exempt from Income Tax in 2026

The Digest: The Federal Government has announced that approximately one-third of Nigeria’s workforce will be exempted from paying personal income tax starting in January 2026, as part of a sweeping reform aimed at creating a fairer, more inclusive fiscal system. Key Points: Workers earning...- Nigeria News

- Article

- 1 min read

- taiwo oyedele tax reform

- Category: Business

-

Nigeria Oyedele Clarifies: Banks to Report Accounts with N25m Quarterly Turnover to Tax Agency

The Digest: Taiwo Oyedele has clarified that the new tax laws will mandate banks to report accounts with a quarterly turnover of N25 million to the tax agency. According to the committee chairman, this raises the reporting threshold from the previous N10 million and is not a new power for...- Nigeria News

- Article

- 1 min read

- taiwo oyedele tax reform

- Category: Business

-

Nigeria Tax ID Mandatory for Nigerian Bank Accounts From January 1, 2026 - FG

The Digest: The Federal Government has announced that all taxable Nigerians must possess a Tax Identification Number to operate bank accounts starting January 2026. According to reports, the policy exempts students and dependents while reinforcing compliance under the new Nigerian Tax...- Nigeria News

- Article

- 1 min read

- taiwo oyedele tax identification number tax reform

- Category: Business