tax reforms

-

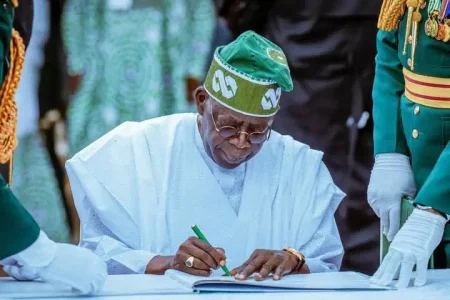

Nigeria Ndume Alleges Tax Law Signed by Tinubu Differs from National Assembly Version, Warns of Legal Crisis

The Digest: Senator Ali Ndume has alleged that the tax reform laws signed by President Bola Tinubu differ from the version passed by the National Assembly. Speaking on Arise TV, Ndume referenced House of Representatives member Abdussamad Dasuki’s earlier claim of discrepancies and stated that...- Nigeria News

- Article

- 1 min read

- ali ndume bola tinubu national assembly tax reforms

- Category: Politics

-

Nigeria KPMG, NRS Hold Meeting After Clash Over Nigeria's New Tax Laws

The Digest: Executives from KPMG met with the Nigeria Revenue Service chairman, Zacch Adedeji, to clarify concerns over recently enacted tax laws. After earlier citing “errors and inconsistencies,” the firm now commended the reforms Key Points: KPMG executives met with NRS chairman Zacch...- Nigeria News

- Article

- 1 min read

- kpmg new tax law nrs tax reforms zacch adedeji

- Category: Business

-

Nigeria Banks Begin 10% Withholding Tax on Foreign Currency Deposit Interest

The Digest: Nigerian banks will commence deducting a 10 percent withholding tax on interest earned from foreign currency deposits starting January 1, 2026, in line with new fiscal reforms. The policy, announced to customers by institutions such as Access Bank, expands the government’s revenue...- Nigeria News

- Article

- 1 min read

- nigeria tax act 2025 tax reforms withholding tax

- Category: Business

-

Nigeria Opposition Mounts Against New Tax Laws as Court Battle Looms

The Digest: The Minority Caucus of the House of Representatives and the National Association of Nigerian Students (NANS) have called for an immediate suspension of the new tax laws, citing allegations that the gazetted versions differ from those passed by the National Assembly. Key Points...- Nigeria News

- Article

- 1 min read

- bola tinubu court house of representatives nans tax reforms

- Category: Politics

-

Nigeria President Tinubu Confirms Tax Reforms Will Proceed as Scheduled

The Digest: President Bola Tinubu has confirmed that the implementation of new tax laws will proceed on January 1, 2026. The president described the reforms as a foundational shift aimed at fairness and competitiveness, not merely a revenue-raising measure. Key Points: Tinubu stated that a...- Nigeria News

- Article

- 1 min read

- bola tinubu tax reforms

- Category: Politics

-

Nigeria NBA Demands Suspension of Controversial Tax Laws Over Gazette Alteration Allegations

The Digest: The Nigerian Bar Association (NBA) has called for the immediate suspension of the recently enacted Tax Reform Acts, citing grave allegations of discrepancies between the laws passed by parliament and the officially gazetted copies. Key Points: The NBA's President, Afam Osigwe...- Nigeria News

- Article

- 1 min read

- tax reforms

- Category: Business

-

Nigeria Oyedele Denies Discrepancies in Tax Laws, Calls Circulating Reports "Fake"

The Digest: Taiwo Oyedele has asserted that there are no discrepancies between the tax laws passed by the National Assembly and the officially gazetted versions. Speaking on Channels Television, Oyedele dismissed the controversy as fueled by unauthorized drafts and called for patience as a...- Nigeria News

- Article

- 1 min read

- national assembly taiwo oyedele tax reforms

- Category: Business

-

Nigeria Tax Committee Chairman Addresses Fears: Oyedele Says Public Panic Stems From Poor Awareness

The Digest: Taiwo Oyedele, Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, has attributed public anxiety over upcoming tax reforms to a critical lack of awareness, not new punitive measures. His clarification seeks to calm fears by separating longstanding law from fresh...- Nigeria News

- Article

- 1 min read

- taiwo oyedele tax reforms

- Category: Business

-

Nigeria Oyedele on Tax Reforms: "No One Can Touch Your Bank Account," Debunks Direct Deduction Claims

The Digest: Taiwo Oyedele, Chairman of the Presidential Tax Reforms Committee, has firmly dismissed fears that the government can directly debit personal bank accounts. According to his statement, such claims are false, dangerous, and could trigger harmful economic panic. Key Points : Taiwo...- Nigeria News

- Article

- 1 min read

- taiwo oyedele tax reforms

- Category: Business

-

Nigeria FG Selects 20 Content Creators to Lead Public Education on Tax Reforms

The Digest: The Presidential Fiscal Policy and Tax Reforms Committee has unveiled a list of 20 prominent content creators chosen to spearhead public education on Nigeria's new tax reforms. Selected from over 8,591 nominations, the creators will undergo special training to deepen their...- Nigeria News

- Article

- 1 min read

- taiwo oyedele tax reforms

- Category: Business

-

Nigeria "We Will Come Knocking": FG's Warning to Nigerians Earning Foreign Income

The Digest: Taiwo Oyedele, Chairman of the Presidential Tax Committee, has revealed that Nigeria has partnered with over 100 nations under the Common Reporting Standards to gather data on remote workers and citizens with foreign assets for tax enforcement. Key Points: Nigeria has...- Nigeria News

- Article

- 1 min read

- taiwo oyedele tax reforms

- Category: Business

-

Nigeria IMF Commends FIRS's "Significant Progress" in Tax Reforms

The Digest: The International Monetary Fund (IMF) has lauded the Federal Inland Revenue Service (FIRS) for achieving "significant progress" in its ongoing reforms and core duties. Speaking at the opening of an IMF-supported mission in Abuja, Paulo Paz, a Senior Economist at the IMF's Fiscal...- Nigeria News

- Article

- 1 min read

- firs imf tax reforms

- Category: Business