New tax regulations in Nigeria, effective October 1, 2024, exempt winnings from games and reality shows promoting innovation and education from withholding tax. This move aims to stimulate national development in key sectors.

The Federal Ministry of Finance in Nigeria has announced new tax regulations, effective from October 1, 2024, that exempt winnings from certain games and reality shows from withholding tax.

This initiative aims to promote entrepreneurship, academics, technology, and scientific innovation.

The new regulations specify that winnings from games of chance and reality shows designed to foster these areas will not be subject to tax deductions at source.

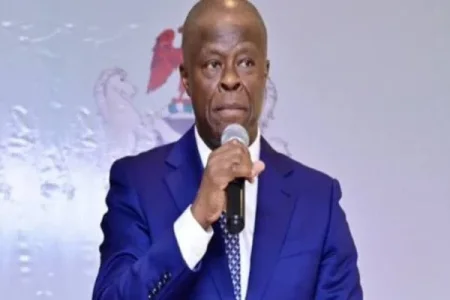

The Honourable Minister of Finance, Adebayo Olawale Edun, emphasized that these exemptions are intended to stimulate innovation and academic excellence.

The new rules define "winning" as the net payout to participants, calculated at the end of each session, which should not exceed one calendar month. This ensures fair taxation on actual net gains received by participants.

The “Withholding Tax Regulations 2024” detail the processes and rates for tax deductions on various transactions. The specific exemptions for games and reality shows highlight the government’s commitment to creating a supportive environment for innovation and education.

Popular reality shows like Big Brother Naija (BBNaija) will benefit from these exemptions. For example, the upcoming Season 9 of BBNaija, starting on July 28, 2024, will see winners exempt from tax deductions on their prize money under the new regulation.

Overall, these tax exemptions aim to simplify the tax process and reduce the burden on taxpayers, encouraging participation in activities that drive national growth.

Source: Nairametrics